Clean audit opinion from the university's external auditors

We are pleased that the university’s audited financial statements, prepared in accordance with Canadian Accounting Standards for Non-Profit Organizations, received an unmodified opinion from our external auditors (Deloitte).

The consolidated audited financial statements reflect an excess of revenues over expenses of $7.3 million. This includes all restricted and unrestricted funds of the university.

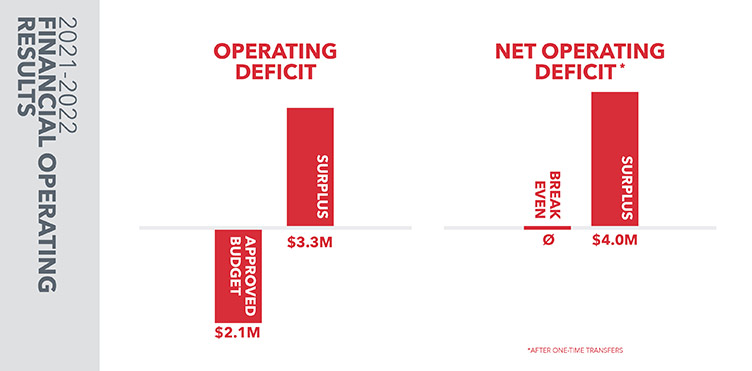

The 2021-22 operating budget was built on the assumption that UNB would gradually return to in-person operations and while it reflected a cautiously optimistic picture, it incorporated the pandemic realities and was presented with a $2.1 million deficit. This deficit was projected to be fully offset by transfers from internally restricted net assets.

Actual results were better than budgeted. With stronger than budgeted ancillary operations, a one year freeze on Professional Expense Accounts and unexpected salary savings, the university ended the 2021-22 fiscal year, with a $3.3 million operating surplus.

UNB has continued to focus on the renewal, modernization, and expansion of its residence system. This will support anticipated enrolment growth as we implement UNB Toward 2030 with new academic programs. In total, the 2021-22 Capital Budget was $17.7 million and included funds for projects such as the Joy Kidd Residence, Oland Hall upgrades and energy management projects.

The UNB Fredericton campus was recognized as a top performer in the 2021 Sustainable Campus Index, ranking second internationally and first overall among doctoral institutions in Coordination and Planning. On April 22, 2021, UNB received the 2020 NB Power Energy Efficiency Excellence Award for the Kinesiology Building.

The UNB Saint John campus received a silver ranking in STARS in 2021-22.

Trust and endowment assets decreased in 2021-2022 by $7.4 million to $373.24 million.

The decrease is due to:

| Donations and other contributions | $16.7M |

| Investment earnings | ($1.6M) |

| Spending | ($22.5M) |

| ($7.4M) |

The Trust and Endowment Fund had negative returns of 0.67 per cent in 2021-2022 as elevated inflationary pressures, less accommodative monetary policy and the Russian invasion of Ukraine gave way to volatility in the markets in early calendar 2022.

In years where investment returns are in excess of what is required to meet spending requirements, inflation protection and administrative costs, the excess is considered a “reserve.” The reserves are drawn down in years when investment returns are less than what is needed to meet those same requirements. For fiscal year 2022, timing reserves were drawn down to meet those requirements. As of April 30, 2022, the university had $29.0 million set aside in the timing reserve fund.