Most New Brunswickers would agree that rising electricity prices are a problem – but few are aware of the ramifications of disproportionately rising rate for large industry. Energy costs are a key factor in the operating cost structure of most industrial firms and an important consideration for manufacturers when choosing where to set up a new facility. Energy costs also impact manufacturers’ decision of whether to stay in a region or relocate operations. It’s important to understand the impacts of electricity rates on large industry because the manufacturing sector contributes significantly to provincial GDP and employment.

In a recent commentary, Dr. Herb Emery described of rising energy costs for large industry played a role in the withdrawal of several international pulp and paper firms from the Northern parts of the province in the early 2000s. This was a period when the province’s trade exposed, high wage pulp and paper producers already faced declining US and global demand for paper products and an appreciating Canadian dollar. When they announced their intention to leave, the firms cited slowing demand for packaging in North America as manufacturing shifted overseas, the competitive disadvantage of a high dollar, and their inability to pass along inflationary costs, such as energy and fiber. Meanwhile, Quebec also faced an appreciating dollar and softening demand for paper products, but its pulp and paper employment did not drop as abruptly as New Brunswick’s. What could have contributed to this disparity?

Dr. Emery’s commentary pointed to the large increases in electricity prices for large industry in the province between 2003 and 2007. As NB Power grappled with rising fuel costs and debt service costs, it raised power prices dramatically, particularly for large industry, as the province decided to put more of the rising costs for power onto large industry rather than lighter industry and residential consumers.

According to the Atlantica Centre for Energy1, NB Power's electricity rates started to escalate at an accelerated pace in the late 1990s, outpacing other jurisdictions in North America. In 2003, amendments to the Electricity Act reorganized NB Power into a holding company with four divisions. Although the revised Act maintained NB Power's distribution, transmission, and nuclear power monopolies, it also opened the door to competition with the goal of fostering a competitive environment for electricity rates in New Brunswick. Unfortunately, what followed was an even faster escalation of industrial and residential electricity rates, due in part to rising fuel costs and significant debt servicing costs.

From 2003 to 2009, NB Power had the second fastest increase in industrial electricity costs of any province in Canada and well above the median increase among U.S. states (Atlantica, 2010). As of 2009, industrial electricity rates in New Brunswick were well above the median in Canada and the United States and 40%-90% higher than areas that directly compete with New Brunswick firms in the forestry industry.

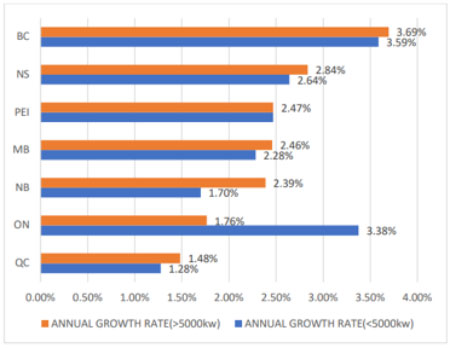

As we see with the chart below, the average annual increase in electricity rates for heavy users (i.e. large manufacturers) was greater in New Brunswick than in six other provinces. Notably, most other provinces - most notably Ontario - chose to put the burden of increased electricity costs on less intensive users.

Figure 1 – Average Annual Increase in Electricity Price (2001-2018)

New research performed by a graduate student in the Economics Department at UNB2 shows that investment by large manufacturers in Canada (defined as those who use electricity over 5000kw) are more sensitive to power rates for electricity than smaller commercial consumers.

Using annual data for seven provinces from 2001 to 2018, the study examined the impact of energy price on manufacturing productivity measured by labor productivity and GDP and the impact of energy price on investment. The results suggested a significant negative correlation between electricity price and GDP, labor productivity, and investment in manufacturing. Although smaller commercial users showed sensitivity to electricity prices were apparent for all three indicators, the impact was greater for large manufacturing.

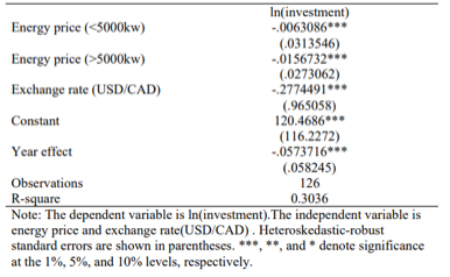

During the study period, an appreciating Canadian dollar played an important role in manufacturing competitiveness and investment due to the country’s reliance on exports to the US. Even when the author included exchange rate as control variable, there was still a significant negative relationship between energy price and productivity and investment, as shown in the example below:

Figure 2 – Impact of electricity price and exchange rate on investment in manufacturing in seven provinces

For most of the 20th century, provincial governments (both liberal and conservative) had a laser-sharp focus on development energy infrastructure to ensure larger industry had access to affordable, reliable energy to grow their operations and remain competitive.

In the 1920s, provincial governments rushed to put energy infrastructure in place to help the burgeoning pulp and paper industry get its footing. Premier Walter E. Foster proposed the creation of a provincially-owned electric company to support economic development in the province, called the New Brunswick Electric Power Commission. However, most hydroelectricity development during would be accomplished by the private pulp and paper firms, with some coaxing and concessions from provincial governments.

In the 1950s, Hugh John Flemming’s government worked with NBEPC to pursue a "power for industry" growth model based on providing inexpensive electricity to heavy industry – with a focus on the mining industry. With the mandate to establish a public monopoly, the NBEPC acquired most of the private and municipal distributors. It also invested in large new hydro projects on the St. John River and increased thermal coal generation at Minto and Chatham and thermal oil generation in Saint John. During the 1950s the NBEPC increased its output five-fold.3

The priority of providing affordable energy for heavy industry continued through the Louis J. Robichaud years. There was pressing need for expanded energy infrastructure by the 1960s, which saw the opening of the Irving Oil refinery, the establishment of more pulp and paper mills, and the manufacturing of industrial by-products like fertilizers. The province looked to thermal and hydro-electric power stations, including a hydroelectric power station the Tobique River near Grand Falls and another in Dalhousie. Another major project was the hydroelectric development of the Mactaquac Basin.

In the 1970s, as more industry was brought into the province and as the pulp and paper industry struggled to remain competitive, New Brunswick needed access to more affordable power. In the 1970s, New Brunswick’s energy capacity came from hydroelectric dams and the rest from thermal plants. The energy project that would define the Richard Hatfield era was the idea of bringing power price stability to New Brunswick through nuclear investments. The site of the province’s first nuclear reactor would be Point Lepreau, near Saint John. When the facility came online in 1983 after a series of delays, New Brunswick became the second province in Canada after Ontario to adopt nuclear power.

More recent governments have efforts toward strengthening the province’s energy infrastructure, but there have been many roadblocks. For example, part of the Graham government’s “self-sufficiency” plan in the late 2000s was to make New Brunswick an “energy hub.” At the time, there were five mega-projects either underway or proposed, including the refurbishment of NB Power’s Point Lepreau nuclear power plant, the addition of an international power transmission line between Saint John and the Maine border, the impending approval of the 145-kilometre Brunswick Pipeline to transport natural gas, the Canaport LNG (liquefied natural gas) facility, and Irving Oil’s proposed second refinery. However, plans to strengthen the province’s energy sector infrastructure and output kept hitting snags. The refurbishment of Point Lepreau ran into lengthy and costly overruns as the timeline stretched years beyond initial completion targets. Irving Oil announced that it was indefinitely postponing its plans to build a second refinery, as plans to build a second reactor also hit road bumps, with Atomic Energy of Canada Limited (AECL) losing interest4. the Point Lepreau nuclear facility, for example, ate up more time and resources than anticipated. The government had some success with clean energy contracts (wind farms) but an ill-fated attempt to sell NB Power assets to a Quebec utility contributed to Graham being pushed from office after only one term.

As discussed above, provincial governments have long understood that access to affordable, reliable energy supply is essential for attracting and retaining large industry. Growth in New Brunswick’s manufacturing exports has stalled in recent years as some firms leave and other struggle to remain competitive. Evidence suggests the sudden, substantial increased in electricity rates for heavy industry had something to do with this.

Back in 2010, the Atlantica Centre for Energy proposed a few solutions, including transferring the weight of NB Power debt from the ratepayer to the taxpayer, or restructuring the rate setting methodology so more of the burden is places on less heavy users. Province could look at specific incentive programs or similar policy tools that would address specific industries or companies based on their economic impact to the New Brunswick economy – this could even include incentives for companies who can generate their own electricity. Atlantica also recommended exploration of regional opportunities to strengthen the electricity business model.

It’s clear that there are a range of policy alternatives to consider – but the real question is whether provincial government will renew its focus on affordable energy supply to ensure it retains its existing industrial base and creates conditions for future export growth.

Sept. 1, 2020

Dr. Sarah McRae is a postdoctoral fellow at the University of New Brunswick and a member of the JDI Roundtable research team.

The JDI Roundtable on Manufacturing Competitiveness in New Brunswick is an independent research program made possible through the generosity of J.D. Irving, Ltd. The funding supports arms-length research conducted at UNB.