The JDI Roundtable team is conducting research to better understand the New Brunswick manufacturing sector compared to surrounding regions. By analyzing data on firm sector, size, employment, and geography in New Brunswick compared to Nova Scotia, PEI, Gaspésie, and Maine, we hope to provide insight into whether the manufacturing and processing industry in New Brunswick is distinct or whether it reflects broader regional trends.

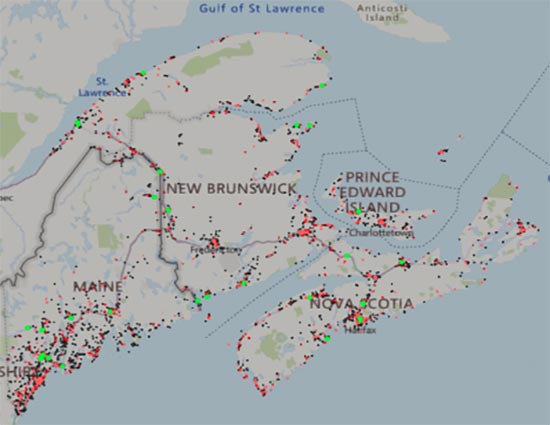

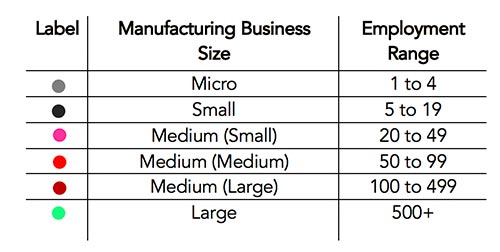

When we map manufacturers by location and numbers of employees, we see that manufacturers are numerous and located throughout the region.

As shown in Figure 1, the South of New Brunswick has more manufacturing firms than the North but there are still a large number in the North. Fredericton and Moncton areas have a high density of small and medium sized establishments while Saint John share a similar density but also has larger manufacturers. The high density of manufacturing establishment in the three dominant urban centres of the province is not surprising given the availability of labour and access to core transportation infrastructure.

When they are not located near a metropolitan area, New Brunswick firms tend to be located near the coast. This may reflect transportation needs, industry-specific needs (e,g, seafood), and settlement patterns (where people tend to live). We see similar patterns in the other regions presented in Figure 1, with denser clusters appearing around Halifax, Rimouski, and Portland and remaining firms situated around the coasts and border regions.

When we consider business size (measured in terms of total local employment), one thing that stands out is that the largest manufacturing employers in New Brunswick (the green dots) are mostly located away from the urban centres - to a greater extent than we see in the other regions (with the exception of PEI, where the largest centre of Charlottetown doesn’t have any large firms). The largest manufacturing and processing firms in New Brunswick tend to be distributed along the coasts and near the Maine border. These large employers are predominantly in food processing, with several of them specializing in seafood preparation and packaging. Due to the importance of seafood processing in the province, it is not surprising that these large firms tend to be located near the coast. In the case of major employers McCain Foods, which has plants situated at Florenceville-Bristol and Saint André along the Highway 2 next to Maine, these locations have the advantage of being near the US border but the chosen locations also have ties also reflect the founding family’s ties to the region.

In Figure 2, we illustrate the top ten manufacturing employers for each region using red dots, where the size of the red dots indicates the numbers of employees for each manufacturing firm.

The largest firms in New Brunswick employ 400 to 990 workers. Of the top ten manufacturing employers in the province, seven are in the food sector. The remaining firms are in the pulp and paper industry.

In comparison, the surrounding regions can be broken down as follows:

Overall, the top manufacturing employers in the five regions examined here represent a comparable mix of industries concentrated around food, paper, transportation equipment, wood, and a smattering of other industries. New Brunswick and PEI are more dependent on food processing industries, while the other regions still have food as a key industry but balance this focus with other key industries such as paper in Maine.

Stay tuned as we continue to visualize and analyze data on the manufacturing industry in New Brunswick and surrounding regions!

July 2, 2020

Dr. Sarah McRae is a postdoctoral fellow at the University of New Brunswick and a member of the JDI Roundtable research team.

The JDI Roundtable on Manufacturing Competitiveness in New Brunswick is an independent research program made possible through the generosity of J.D. Irving, Ltd. The funding supports arms-length research conducted at UNB.