Investment is an important indicator of an economy’s health. It’s a fundamental determinant of productivity and Gross Domestic Product (GDP). Economies and sectors with higher levels of investment tend to have larger capital stocks which result in higher productivity and higher incomes. For New Brunswick, which relies on exports for growing its GDP, investment in new machinery, equipment, buildings, and state of the art technologies is critical for maintaining competitiveness and reaping the advantages of scale economies.

So, to understand the health of New Brunswick’s manufacturing sector, we need to have a clear picture of what’s happening with investment. But how exactly do we measure investment? In this blog series, we’ll be looking at some essential terms that can shed light on the state of investment in manufacturing in New Brunswick. These include:

Capital Stocks (or Real Capital Stocks)

First, we’ll be looking at Capital Stocks, which are produced with investment.

The manufacturing sector accounts for the second-largest share of NB’s capital stock

In New Brunswick’s business sector (that is, the whole economy minus education, health care and public administration), the manufacturing sector makes up an important share of the total capital stock. Manufacturing accounted for over 20% of New Brunswick business sector capital between 1997 and 2007, but it has decreased since then to 15% of the business sector capital stock, largely owing to the falling share of paper manufacturing capital stocks. But it remains the second largest industry behind utilities.

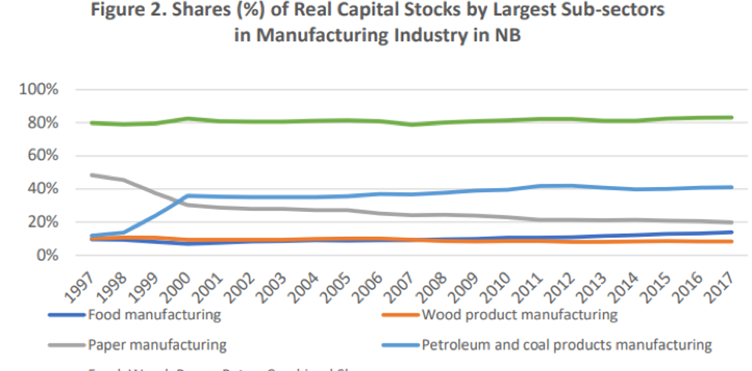

Within New Brunswick’s manufacturing industry, capital is concentrated within a few significant sub-sectors: food manufacturing, wood product manufacturing, paper manufacturing, and petroleum and coal product manufacturing. These four sub-sectors have consistently accounted for approximately 80% of the manufacturing capital stock.

Petroleum and food sub-sectors hold the largest shares of NB’s manufacturing capital stock

Paper manufacturing once accounted for the largest single share of NB’s manufacturing capital stock - close to 50% in 1997 - but it has fallen steadily since then, and now holds close to 20% of the capital stock. Meanwhile, petroleum’s share saw significant growth between 1998 and 2000, and it has become the single largest sub-sector. Food manufacturing and wood product manufacturing’s positions have held steady, with food manufacturing increasing its share slow from 7% in 2000, to 14% in 2017. None of the other sub-sectors ever rose above a 5% share.

Even if we remove petroleum and coal manufacturing from the equation, capital stock in NB’s manufacturing industry is still more concentrated than in the other provinces and Canada.

Source: Statistics Canada. Table 36-10-0096-01

Measured in 2012 Chained Dollars

Total NB manufacturing capital stock has been in decline since 2008 – but some industries are still growing investment

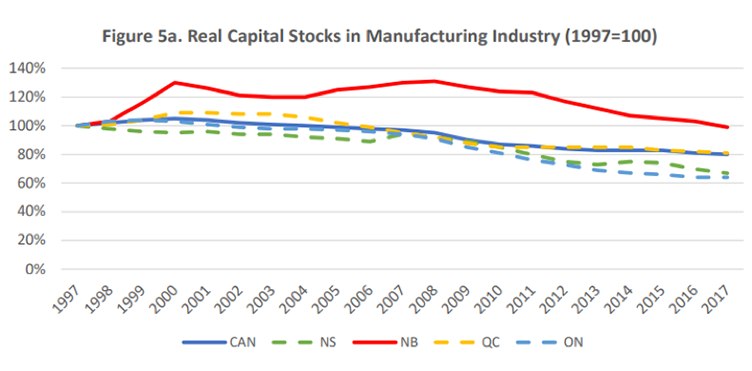

Now that we have an idea of how manufacturing sector’s share of capital stock has changed in recent decades, let’s turn to total capital stock in the manufacturing industry. How has manufacturing’s capital stock in NB changed over the last twenty years, and how does that compare to other provinces, and Canada as a whole?

Total manufacturing capital stocks across the country have largely decreased, particularly since 2007. We see a similar pattern across the country and in other provinces, as shown in Figure 5a below. In New Brunswick, manufacturing capital stock increased between 1997 and 2000, and remained stable to 2008 before declining from 2008 until 2017. From 1997 to 2008, New Brunswick saw less decline in manufacturing capital stock than Canada as a whole - this was largely due to petroleum and coal product capital stock growth. Food manufacturing was the only sub-sector that had growth over the entire 1997-2017 period.

Source: Statistics Canada. Table 36-10-0096-01

Measured in 2012 Chained Dollars

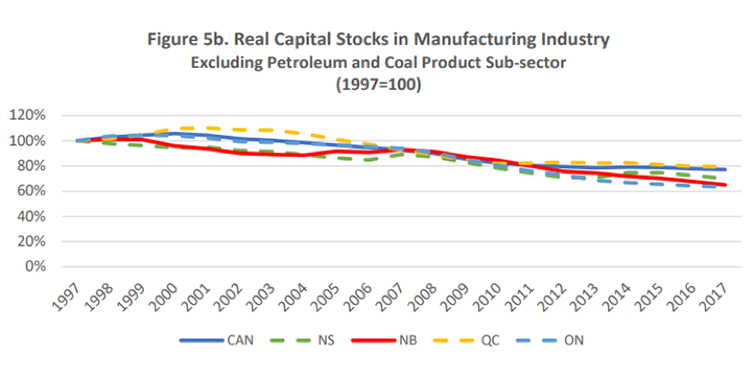

After removing petroleum and coal product manufacturing capital from manufacturing totals, the New Brunswick trend changes significantly. It no longer has a sharp growth between 1997 and 2000. Following a slight recovery from 2004 to 2007, the size of the manufacturing capital stock declines each year to 2017, falling to almost 60% of the 1997 value.

Source: Statistics Canada. Table 36-10-0096-01

Measured in 2012 Chained Dollars

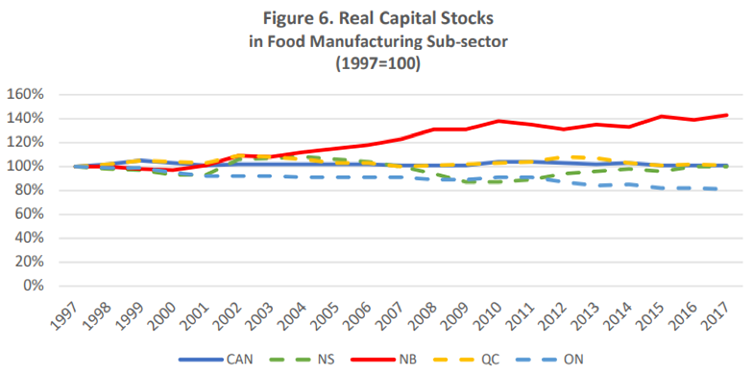

One notable exception to the trend of decline in recent years is the food manufacturing sector. Figure 6 below shows New Brunswick’s capital stock in food manufacturing had a long-term increase over the 1997-2017 period. This is in contrast to the patterns seen in Canada and the other provinces, which fluctuated but did not change significantly over the whole period, with the exception of Ontario, which decreased steadily.

Source: Statistics Canada. Table 36-10-0096-01

Measured in 2012 Chained Dollars

Declining capital stocks is a nationwide trend, but is it inevitable?

So, what can we take away from this information? Since 2008, New Brunswick has mostly been following the trend of declining capital stocks seen in other provinces, especially if we remove the coal and petroleum industry from the equation.

However, a growth trend over the past two decades in the food manufacturing sub-sector shows that this decline is not inevitable, and that companies in the food sector are increasing investment in physical assets like equipment.

Of course, capital stocks as a product of investment only describe one aspect of the investment climate in manufacturing. As we discussed in a previous post, the food processing industry in New Brunswick is beset by labour supply issues – will investments in innovation and productivity enhancing technologies help them offset those problems, or will the current labour market pressures in New Brunswick drive food production elsewhere?

The charts and analysis featured in this blog post are excerpted from “Adding Horsepower: Capital Stocks and Productivity Measures in New Brunswick’s Manufacturing Sector” (2019), by Andrew Balcom and Li Wang.

Dr. Sarah McRae is a postdoctoral fellow at the University of New Brunswick and a member of the JDI Roundtable research team.

The JDI Roundtable on Manufacturing Competitiveness in New Brunswick is an independent research program made possible through the generosity of J.D. Irving, Ltd. The funding supports arms-length research conducted at UNB.